How To Pay A Ticket Online In Iowa

Employ the Pay Fines Online link above or go to the Iowa Courts Online case search page. You must have the following data:

- Name of the county in which the fine was imposed or assessed,

- General type of charge (traffic, simple/criminal, or ceremonious infraction), and

- Case or commendation number. If you do not know this number you may search using your name.

Later you submit this information, the arrangement will search for matching cases. Follow instructions to brand your payment.

When yous pay a fine online information technology is a plea of guilty. You but need to appear if the box on the ticket marked "courtroom appearance required" is checked.

According to Iowa law, fines and fees are due to the clerk of court 30 days afterward the date information technology is assessed past a court order.

Yes, once the transaction is completed, a confirmation screen will brandish. Impress or make a screenshot of the confirmation screen for your records.

Clerk of court offices strive to post information every bit shortly equally possible. Because clerks' offices handle big volumes of work, data is not always posted the day a record is filed.

In the example of citations or tickets, it may accept a week or longer from the date the citation or ticket is issued to the date it is filed in the clerk of court office. This interval may be longer if a citation is issued on a weekend or holiday. If the information does non appear on this site after fourteen days, delight contact the clerk of court office in the county where the citation was issued.

Court debt means all fines and fees ordered by the court. According to Iowa police, a judge may order whatsoever or all of the following:

- Restitution for victims of criminal offence.

- Fines, penalties, criminal penalty surcharge, and law enforcement initiative surcharge.

- Crime Victim Compensation Fund.

- Court costs, including correctional fees, court-appointed attorney fees, and public defender expenses.

All court debts are paid in the priority order listed above. Pay court debt to the clerk of court in the county where the violation occurred. The Clerk of Court offices are listed on the Court Directory page.

When the court assesses the debt, you receive an order. When the debt becomes delinquent, you lot volition receive a notice from the clerk of court in the canton where the violation occurred.

Be alert for potential scams, including spam emails falsely claiming to exist from the Iowa Judicial Branch or a court official. The Iowa Judicial Branch will never send an electronic mail that asks you lot to send money, give a social security number, direct you to telephone call a certain phone number, or advise you to download a certificate from inside the email.

Pay your court debt to the clerk of courtroom in the county where the violation occurred. The Clerk of Court offices are listed on the Courtroom Directory page.

It depends. You volition be notified of your payment options past either the canton attorney or the private debt collector when your debt has been assigned.

- If a county attorney has entered into an agreement with Country Court Administration and has committed to collecting court debt, and then the debt volition be assigned to the county attorney when the debt is delinquent.

- If the criminal offense occurred in a county where the county chaser has not committed to collecting, then the debt will exist assigned to a private debt collector that is nether contract with the judicial branch to collect debt owed to the State of Iowa when the debt is runaway.

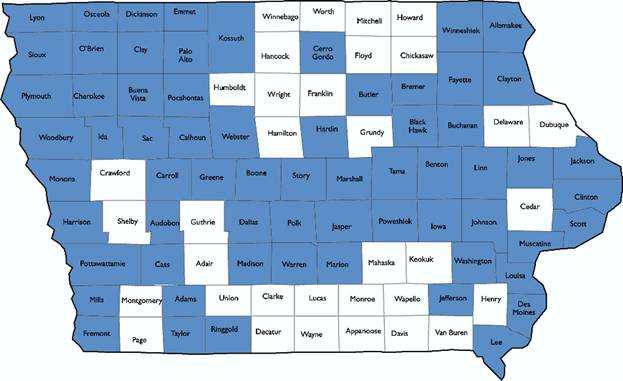

On the map, night counties indicate county attorneys collect court debt, light counties indicate a private debt collector collects court debt.

Counties where the county chaser collects courtroom debt more than 30 days past due.

- Adams

- Allamakee

- Audubon

- Benton

- Black

- Boone

- Bremer

- Buchanan

- Buena Vista

- Butler

- Calhoun

- Carroll

- Cass

- Cerro Gordo

- Cherokee

- Clay

- Clayton

- Clinton

- Dallas

- Des Moines

- Dickinson

- Emmet

- Fayette

- Freemont

- Greene

- Hardin

- Harrison

- Ida

- Iowa

- Jackson

- Jasper

- Jefferson

- Johnson

- Jones

- Kossuth

- Lee

- Linn

- Louisa

- Lyon

- Madison

- Marion

- Marshall

- Mills

- Monona

- Muscatine

- O'Brien

- Osceola

- Palo Alto

- Plymouth

- Pocahontas

- Polk

- Pottawattamie

- Poweshiek

- Ringgold

- Sac

- Scott

- Sioux

- Story

- Tama

- Taylor

- Warren

- Washington

- Webster

- Winneshiek

- Woodbury

Yeah, in the following situations:

- Whatever county attorney collecting courtroom debt can collect any debt related to a violation of state traffic laws or laws of the road.

- A canton attorney from ane canton tin can enter an agreement to collect court debt for one or more than contiguous counties. In this situation a county attorney other than where the violation occurred may collect the court debt.

Except for these 2 situations, the county attorney where the violation occurred or a third political party debt collector designated past the judicial co-operative must collect the debt.

The legislature has prescribed statutory penalties to encourage y'all to pay court debt within 30 days after the engagement assessed.

If your court debt becomes delinquent, you will be unable to renew your motor vehicle registration or driver's license.

For any traffic or traffic related offense, if you have not paid the court debt 30 days after it was assessed by a court lodge, your driver's license will be suspended by the Section of Transportation. Your driver's license or motor vehicle registration may be suspended until yous enter into a payment program.

Other actions could include withholding your state taxation refund beingness withheld or recovering your lottery winnings.

Yes. The Section of Administrative Services recovers debt owed to the State of Iowa, including court debt, using income taxation offsets through the Income Tax and Vender Offset Program. If your tax refund is beingness held due to outstanding court debt, yous volition receive a notice from the judicial co-operative.

There are other country and county entities that can withhold owed fees from your state income tax refund.

No. The amnesty program administered by the Iowa Department of Revenue concluded on November 30, 2010. The General Assembly enacted SF2428 (Runaway Debt Collection Act) in 2008 and SF2383 (Debt Collection Act) in 2010. Both Acts made various changes to the existing debt drove programs and created new programs, including instituting a court debt amnesty program administered by the Iowa Department of Revenue from September one, 2010, through Nov 30, 2010. The immunity program allowed individuals attributable court debt to pay but l% of the fines and fees ordered by the court. No amnesty program has been statutorily enacted since 2010.

No. However, a canton attorney may file a antipathy of court action for failure to pay your court debt.

Yeah. Anyone with lottery, casino, or racetrack winnings of at least $ane,200 is checked before payout to determine if the person has outstanding debt owed to the State of Iowa, including courtroom debt. If debt is owed, the Department of Administrative Services recovers the money through the Income Tax and Vender Commencement Program.

If a fine or fee is not paid inside 30 days after the engagement it is assessed, the court debt is statutorily deemed delinquent. Iowa constabulary does not allow the courtroom to grant orders for extension. In order to avoid malversation, you can gear up a payment plan with the courtroom. Contact the clerk of court function in the county where the violation occurred to inquire about payment plan options. The Clerk of Court offices are listed on the Courtroom Directory folio.

If a judge sets up a payment plan for you at the time yous brand a court appearance, the minimum payment is $50. All the same, if you do not pay the debt within 30 days afterward the date it is assessed, it is collected by a party outside of the court organisation and you will need to negotiate the monthly payment with that entity.

If the payment plan is established by a judge with a courtroom social club or through the applicative county attorney office, there is no interest involved. Notwithstanding, if a payment plan is established through a private debt collector, there will exist a fee up to 25% added to the total debt owed.

Iowa law authorizes the judicial branch to contract with a private debt collector for collection of debt owed to the State of Iowa.

Yep. In that location are federal and state laws that apply to debt collection. Yous should consult an attorney or an Iowa Legal Aid office for an explanation of your rights.

A parking ticket is issued by local law enforcement (metropolis or county) and is nerveless through the city or county clerk office. If y'all choose to challenge a parking ticket, the court may club fines and fees. Any courtroom debt is payable to the clerk of the commune court in the canton where the violation occurred.

When yous pay your fines, fees, and court costs, the money goes to the general fund of the land of Iowa. The land general fund distributes the monies to various state programs and agencies.

If you pay county sheriff jail fees (room and board fees) and fees for service of procedure performed by canton law enforcement, those monies are distributed to the county.

If the violation involves a city ordinance or law and a estimate orders payment of the fines and fees in a court order, these monies are distributed to the metropolis.

No, the State does not keep the credit carte information provided through Iowa Courts Online once a transaction is complete.

Yeah, Iowa Courts Online is secure. Make certain that your system and network are equipped to make a secure transaction.

We have identified a programming error and are working to correct it. Please disregard any negative balance postings.

Source: https://www.iowacourts.gov/for-the-public/pay-a-fine

0 Response to "How To Pay A Ticket Online In Iowa"

Post a Comment